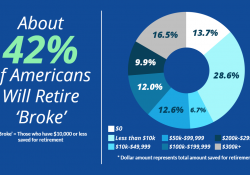

About 42% of Americans Will Retire ‘Broke’… Don’t Be Among Them!

(Watch the video at the end of this post)

*** “Broke” are those who have $10,000 or less saved for retirement.

DON’T BE A STATISTIC!

That risk has been driven by depressed earnings, depressed asset values and increased health-care costs — causing 74 percent of Americans planning to work past traditional retirement age. Additionally, both private and public pension plans have been allowed to become seriously underfunded. So what can be done?

Fundamental changes in the structure of the U.S. economy, combined with increased health-care costs and lack of saving, have created a financial trap for millions of American workers heading into retirement.

Roughly 40 percent of Americans who are considered middle class (based on their income levels) will fall into poverty or near poverty by the time they reach age 65, according to the study.

The study also concluded that if workers age 50 to 60 decide to retire at age 62, 8.5 million of them are projected to fall below twice the Federal Poverty Level, with retirement incomes below $23,340 for singles and $31,260 for couples. Further, 2.6 million of those 8.5 million downwardly mobile workers and their spouses will have incomes below the poverty level — $11,670 for an individual and $15,730 for a two-person household.

It can be debated as to how this happened. Who is to blame? Who is ultimately responsible for a retiree’s well-being in retirement?

Most importantly, though, employers and employees need to focus on a fix. Personal savings is obviously a needed conversation. And sponsors of pension plans — whether corporate, governmental or multi-employer — need to ensure they are doing their part.

Not coincidentally, older Americans increasingly continue to work longer than their forebears. More than 20 percent of the workforce in the United States is 55 or older, a historic high, and that percentage is expected to increase — 74 percent of Americans now say they plan to work past traditional retirement age.

Are there any solutions?

Email Marketing, Affiliate marketing, internet marketing or your own online business can be the solution to this retirement problem.

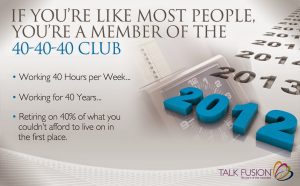

And you don’t want to get stuck in this crazy plan “40-40-40”:

Watch this video. It can be your solution (click on the image below).